Find out how you can pay all your bills from just your dividend pocket.

Building a passive income stream is the holy grail of financial independence, a concept that’s been popularized for good reason.

Passive income is about creating a cash flow that works even while you’re not, and dividend investing is one of the most effective and reliable ways to make this happen.

Unlike the volatility of capital gains, dividends offer regular payouts, giving investors a consistent income that can increase over time.

When strategically handled, dividend growth investing is more than just stock picking—it’s a calculated approach to harnessing the power of compounding returns over years, leading to substantial, sustained income that few other passive income models match.

The strategy focuses on choosing stocks from companies with a history of regularly increasing dividends.

These companies, usually well-established in sectors like utilities, healthcare, or consumer goods, have predictable earnings and maintain strong financial health.

Dividend growth investing takes advantage of this stability by not only holding shares but reinvesting the dividends into purchasing more shares of these income-generating stocks.

Over time, these reinvestments amplify the power of compounding.

Every dividend received and reinvested builds your share count, which, in turn, increases future dividends—a self-sustaining cycle that grows your income while requiring minimal management from you.

At the heart of this approach is reaching the “dividend crossover point,” the moment when your dividend income finally meets or exceeds your living expenses.

Reaching this point means that your portfolio has grown to a stage where it can fully fund your lifestyle without needing additional contributions.

DISCLAIMER: Be advised, this is not professional financial advice. Consult your financial advisor.

This is financial independence driven by dividends alone, and once it’s achieved, your income becomes genuinely passive.

Each dollar reinvested brings you closer to this threshold, making dividend growth investing a powerful roadmap for those aiming to let dividends, not work hours, cover all their bills.

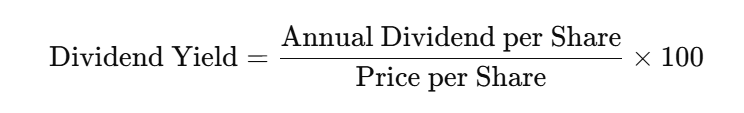

DIVIDEND YIELD

Dividend yield is a ratio that shows how much a company pays in dividends each year relative to its stock price.

Formula

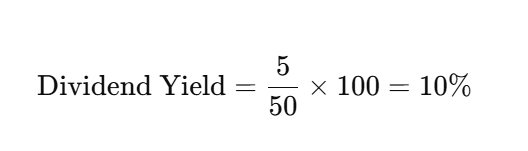

Example

If a company pays $5 in dividends per year and its stock is priced at $50, the dividend yield would be:

This means you get a 10% return yearly from dividends alone.

Why Dividend Yield is Essential to Cover Your Expenses with Dividend Income

Dividend yield shows how much money you get back from a stock just from dividends, compared to its price. It’s like getting interest from a savings account.

Dividend yield is important because of…

- Regular Income: If you want steady cash flow from your investments, dividend yield tells you what to expect.

- Comparison Tool: It helps you compare different stocks. A higher yield means more income, but watch out for unusually high yields—they can be a red flag.

- Market Insight: In the S&P 500, average yields give you an idea of typical returns. Changes in yield can signal shifts in the market or company strategies.

With S&P 500 investments, a higher dividend yield sets a solid foundation for immediate income.

The average dividend yield for S&P 500 companies typically hovers around 1.5-2%, but companies like Verizon (VZ) or Chevron (CVX) often yield significantly more—around 4-6%.

This higher yield gives you more upfront cash flow, which, when reinvested, buys additional shares that boost your income cycle and shorten the time needed to cover your bills with dividends.

By targeting S&P 500 stocks with relatively higher yields, you’ll speed up your income growth without losing stability.

DIVIDEND GROWTH

Dividend growth refers to the increase in dividend payouts over time. Dividend growth measures how much a company increases its dividend payments over time. It’s like getting a raise every year.

Formula

Example

If a company paid $1.50 per share in dividends last year and $1.65 this year, the growth rate would be:

Why Dividend Growth Rate is Essential to Cover Your Bills with Dividend Income

Both dividend yield and dividend growth rates are important. Yield indicates current returns, while growth shows future potential.

Many S&P 500 companies aim to increase dividends over time, suggesting financial health and stability.

- Financial Health: Companies that consistently grow dividends are usually financially strong and profitable.

- Future Income: Growing dividends mean your income from the stock increases over time.

- Inflation Protection: Helps your income keep pace with rising living costs.

- Stability: Companies with steady dividend growth are often more reliable and stable.

- Long-term Strategy: Indicates that the company is focused on long-term growth and shareholder returns.

- Resilience: Companies that can grow dividends even during tough economic times show strong resilience.

- Portfolio Strength: Focusing on dividend growth helps build a robust and profitable investment portfolio over time.

For S&P 500 stocks, a strong dividend growth rate indicates a consistent commitment to increasing payouts, a key factor when aiming to cover all expenses.

Companies like Microsoft (MSFT) and Johnson & Johnson (JNJ) have annualized dividend growth rates around 10%, meaning your income from these stocks will likely double in about seven years with reinvestment.

This compounding from growth means that even if your starting yield is modest, your income level rises faster, covering your bills sooner than relying on yield alone.

More reasons why dividend yield and dividend growth rate are essential in helping you build enough dividend income from S&P 500 investments to cover all your bills:

Inflation Protection Through Growth

With dividend growth stocks in the S&P 500, a rising dividend growth rate helps counter inflation, keeping your passive income on pace with or ahead of living expenses.

When companies like Coca-Cola (KO) and Procter & Gamble (PG) raise their dividends by 3-5% annually, you protect your purchasing power.

This ensures that your dividend income doesn’t just cover bills now but can continue to do so in the future as living costs rise, securing a stable income that grows along with real-world expenses.

Compounding Effect: Reinvesting Both Yield and Growth

Combining yield with a strong growth rate leads to accelerated compounding.

When you reinvest dividends from S&P 500 companies, your returns multiply over time because each reinvested dollar earns dividends itself.

A $10,000 investment in an S&P 500 dividend growth fund growing at 8% annually could grow to over $46,000 in 20 years with reinvestment, boosting your income exponentially and covering your bills faster than a simple high-yield approach.

Dividend Growth as an Economic Pulse Check

Tracking dividend growth is not only about increasing your income; it also provides a real-time snapshot of broader economic and company health.

When companies grow their dividends consistently, it suggests they have the cash flow and revenue stability to return value to shareholders even in varying market conditions.

This reflects not just company performance but economic resilience in the sectors these companies operate in.

For S&P 500 companies, dividend growth has historically aligned with periods of economic growth.

When the economy is strong, businesses generally see increased revenues and profitability, enabling them to increase dividends.

Conversely, if dividend growth slows or stops across large sectors of the S&P 500, it may signal a weakening economy, hinting at possible broader market shifts.

Analyzing dividend growth alongside market trends offers a more reliable metric for future stability, making it a crucial factor for income investors aiming to cover expenses.

Identifying High-Stability Companies through Dividend Consistency

Companies with a long record of dividend growth, often called “Dividend Aristocrats” or “Dividend Kings,” tend to be established, financially sound, and operate within industries less sensitive to economic cycles, like consumer staples, utilities, and healthcare.

Their ability to increase dividends, even during downturns, indicates a strong balance sheet and stable cash flow.

This can be essential when relying on dividend income to cover bills, as these companies are less likely to cut or suspend dividends in a downturn.

Dividend growth, rather than just a high dividend yield, is a signal of management’s commitment to a sustainable long-term strategy.

High-growth companies in the S&P 500 with stable dividend increases show that they’re reinvesting in core growth areas while maintaining shareholder returns.

This provides income investors with greater reliability and peace of mind—qualities essential when aiming to depend on dividends alone to meet living costs.

Companies like Johnson & Johnson and Procter & Gamble are well-regarded for their dependable dividend policies that align with robust growth models.

Dividend Growth as a Predictor of Long-Term Performance

Companies with consistent dividend growth tend to perform well over the long term.

This is because dividend growth often coincides with operational success, strong earnings, and a well-managed financial structure.

In the S&P 500, dividend growth has historically been a leading indicator of financial health, earnings stability, and management effectiveness.

Companies with strong dividend growth rates are often those that outperform their peers, as their dividends are backed by consistent earnings growth.

A high dividend yield alone may seem attractive, but without growth, it’s unsustainable over time.

A growing dividend yield—where the dividend per share increases annually—amplifies returns while helping you stay ahead of inflation.

Additionally, it often signals that management is focused on shareholder returns and is confident in their ability to generate revenue growth.

For investors aiming to cover all expenses through dividends, both yield and growth are key, as a high growth rate increases the total yield over time, compounding your income in alignment with your needs.

Critical Drivers in Utilizing Dividend Yield and Growth to Sustain Monthly Obligations

- Corporate Debt Levels

High corporate debt can seriously affect a company’s ability to increase dividends.

AT&T, with its historically high debt load due to acquisitions, faced pressure to cut its dividend in 2022 to manage its leverage. Interest payments on this debt can eat into cash flow, reducing what’s left for dividends.

Watch debt-to-equity ratios closely; companies with a D/E above 1.0 or an interest coverage ratio below 4 may struggle to sustain or grow dividends, especially if economic conditions tighten and borrowing becomes more costly.

Companies like Apple, with low debt and massive cash reserves, have much more flexibility to increase dividends consistently.

- Dividend Payout Ratio Flexibility

The payout ratio shows how much of a company’s earnings are devoted to dividends.

Utility companies, like Duke Energy, often have high payout ratios (around 70-80%) due to steady cash flow but little room for dividend growth.

In contrast, tech companies like Microsoft, with a lower payout ratio (around 30%), can increase dividends faster due to higher retained earnings for reinvestment.

For dividend growth potential, look for companies with payout ratios under 60% and stable earnings, which indicate more flexibility to raise dividends without jeopardizing reinvestment or stability.

- Share Buyback Trends

Buybacks can be a double-edged sword for dividend growth.

Companies like ExxonMobil prioritize buybacks in strong cash flow years, which can reduce the number of outstanding shares and indirectly increase dividend yield per share.

However, buybacks can also drain resources available for dividend increases.

When companies prioritize buybacks—like Apple, which spent over $90 billion on buybacks in 2022—it might signal limited dividend hikes if resources are directed away from dividends.

The dividend growth potential becomes limited if buybacks dominate the capital allocation strategy, so it’s wise to check if a company’s buyback spending overshadows dividend payouts.

- Sector-Specific Risk and Regulation

Sectors like utilities and healthcare are heavily regulated, impacting dividend growth.

Regulatory changes can influence payout stability for utilities like Southern Company, where rate freezes or mandated capital spending can restrict cash flow available for dividends.

Similarly, healthcare companies, especially those with high exposure to government-funded programs, face pressures that can limit dividend growth if regulatory costs rise.

Examining each sector’s regulatory landscape and specific risks to cash flow stability is crucial, especially in environments where regulations are tightening or where these costs are rising faster than revenue growth.

- Dividend Tax Policy Changes

Dividend tax policy shifts can impact a company’s dividend strategy.

If the U.S. were to raise the tax on qualified dividends, companies may reconsider increases, especially those already offering low growth rates, to avoid higher tax burdens for shareholders.

Tax hikes can lead companies to retain earnings instead of paying them out as dividends.

Historical changes, such as the 2003 reduction in dividend tax rates under the Bush administration, encouraged more dividend payouts.

Similarly, monitoring potential legislative changes helps you anticipate whether S&P 500 companies might adjust their dividend strategies based on the tax environment.

- Global Exposure and Currency Risk

S&P 500 companies like Coca-Cola and Procter & Gamble generate over half of their revenue internationally.

Currency fluctuations—such as a strong dollar—can reduce the value of overseas earnings, impacting dividend potential.

When the dollar strengthens, it can significantly lower the repatriated profits from foreign markets, squeezing margins and, subsequently, cash flow.

This effect has already impacted dividend payers with substantial foreign exposure, including IBM and McDonald’s.

To gauge how currency risk could affect dividend growth, check the percentage of a company’s revenue from international markets and its exposure to volatile currencies.

- Management’s Capital Allocation Strategy

Management’s capital allocation decisions directly impact dividends.

Companies with heavy R&D spending, like Alphabet and Amazon, often reinvest earnings into growth initiatives rather than dividends.

In contrast, companies like Procter & Gamble, known for prioritizing shareholder returns, allocate a higher percentage of their cash flow to dividends and have consistently raised dividends for over six decades.

Reviewing capital allocation statements in quarterly reports can reveal a company’s commitment to dividend growth, giving insight into whether dividend payouts will remain a priority as you work toward covering your living expenses.

Steps to Grow Your Dividend Passive Income Until It Covers ALL Your Bills

Step 1: Select Dividend Growth Stocks

Target “Dividend Champions” with Substantial Buybacks

If you want to cover your hefty bills purely on dividend income, you’re going to need stocks that do more than just pay a solid dividend. You need dividend growth paired with strategic share buybacks.

Dividend aristocrats (those famous high-dividend companies that have raised their payouts for 25+ years) are solid but can be too conservative and not always high-growth. What you want are stocks that aren’t just paying high dividends but are also committed to aggressive share buybacks. Why?

- Share Buybacks reduce the number of outstanding shares. Fewer shares mean that the total dividend payout gets split among fewer shareholders. This results in higher earnings per share (EPS) and, often, higher dividends per share over time without requiring massive revenue growth.

- This double-compounding effect is the jackpot: as the company’s share count decreases, each share represents a larger slice of the company’s earnings. Over time, the growth in EPS allows companies to increase dividends even more significantly.

Finding These Dual-Compounding Stocks

Screen for Companies with High Dividend Growth and Buybacks.

/Stocks like Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL)—not typically high-yielders—are known for substantial buybacks alongside their growing dividends. As of 2024, the Information Technology, Communication Services, and Financials sectors led the S&P 500’s buybacks, with tech giants making up nearly a quarter of all buybacks in early 2024. Apple, for instance, returned over $100 billion to shareholders through buybacks in 2023, while still maintaining steady dividend growth. The double compounding from these actions significantly increases your per-share dividends in the long run, even if dividend yields initially seem low.

Look for S&P 500 companies that have increased dividends consistently but aren’t necessarily considered “aristocrats.” Focus on their recent track records of double-digit dividend growth rates and aggressive share buybacks. Financial sites like Seeking Alpha, Morningstar, and Yahoo Finance have screens for these metrics.

What Ratios to Watch

Payout Ratio: Aim for companies with a payout ratio below 70% (meaning they’re not paying out every dollar they earn as dividends). A lower payout ratio means they’re reinvesting or buying back shares while still covering your dividends.

Share Buyback Yield: This metric shows the percentage of outstanding shares a company buys back each year. Look for buyback yields over 5%, indicating the company is reducing its share count at a pace that compounds with dividend growth.

Best Sectors for Dividend & Buyback Stocks

- Technology and Consumer Discretionary sectors are increasingly competitive here. Companies like Apple and Microsoft lead in buybacks while consistently boosting dividends. Unlike older dividend-heavy sectors (like utilities), these growth-oriented sectors can provide double-compounding effects because they’re not only rewarding shareholders but also expanding aggressively.

- Financials: Certain banks and asset managers have strong buyback programs, but the downside is they can be sensitive to interest rates and economic cycles. Look for diversified financials with a reliable dividend and buyback history.

DON’T GET BLINDSIDED

Stocks with super-high dividend yields (above 6–7%) often signal risk rather than reward. Such yields can be unsustainable, and companies might eventually slash dividends, leaving you with less income.

Not every company buying back shares is doing it effectively. Some companies buy back shares only to issue new ones, effectively undoing the buybacks. Check that the net shares outstanding actually decrease over time.

Just because a company pays a dividend doesn’t mean it’s worth holding. You need companies with solid growth prospects—otherwise, your investment may lag behind inflation, eroding your purchasing power over time.

Identify Companies with High Free Cash Flow Yields

/Analyze companies not just for dividend growth but for high free cash flow yields—this metric shows how much cash is left after capital expenditures and can give you insight into a company’s ability to increase dividends over time. S&P 500 companies with high cash flow yields often have more flexibility to continue paying and raising dividends, even in downturns.

Follow the Dividend Reinvestment Patterns of Institutional Investors

/Some institutional investors maintain dividend-focused funds that have insider access to company stability reports before the public does. Certain S&P 500 dividend stocks tend to receive consistent reinvestment from these funds, which signals confidence from big players in their long-term dividend sustainability and growth.

Select Sectors with Consistent Payouts and Low Dividend Cuts

/Sectors like Health Care and Consumer Staples are dividend stalwarts, typically avoiding cuts due to their resilient business models. Dividend aristocrats here, such as Johnson & Johnson (JNJ) or Procter & Gamble (PG), are known for steady growth. But rather than selecting typical high-yielders, look for those with buyback histories to amplify the compounding effect. J&J’s commitment to buybacks, for example, has been strategic, aiming to offset shareholder dilution over time, which enhances the per-share earnings and dividends.

Avoid Overly Aggressive Yields

/High-yield stocks in sectors like Energy or Utilities may offer tempting returns but come with inherent volatility. Although ExxonMobil (XOM), a top S&P buyback leader, boasts dividends, the energy sector’s cyclical nature can lead to dividend cuts during downturns. In fact, dividend cuts within the S&P 500 dropped notably in early 2024, but energy companies have been more susceptible to these adjustments, so ensure you’re comfortable with any potential payout fluctuation.

Set Up a High-Yield Strategy with Controlled Expenses

/If your goal is covering all bills, managing the allocation between growth-focused buybacks and dividend yields is crucial. A balanced approach involves reinvesting the dividends from moderate-yield stocks and allowing buybacks to enhance your shares’ value over time. For example, reinvesting dividends from stocks like Apple or Microsoft into a diversified set of companies that meet both criteria (dividend growth and buybacks) may yield smoother returns and higher coverage for your expenses.

Step 2: Add New Money Regularly

MAX OUT CONTRIBUTION CYCLES WITH LADDERING PURCHASES

Break down contributions into bi-weekly or even weekly additions.

Let’s say you get paid bi-weekly. By setting up automated investments on or near your paydays, you’re building up your portfolio gradually, like a savings account that’s actually growing for you.

Investing $500 bi-weekly instead of $1,000 monthly smooths out the entry points—you capture a bit of the market’s ups and downs, meaning you buy more shares when prices dip and slightly fewer when they peak.

Over time, this approach averages out your cost per share. It’s called dollar-cost averaging (DCA), but done on a faster cycle than typical monthly contributions, giving you more opportunities to catch minor dips, which boosts your overall yield.

Laddering entries over multiple days within each month captures micro-dips in prices, building up a larger position at favorable prices without depending on market timing.

Laddering your entries across different days in each month gives you a better shot at “micro-dips”—those minor price fluctuations that can add up over time.

If you’re investing $1,000 per month, split it into four $250 entries over different days of the month. You might hit a down day on one, a flat day on another, and a slightly up day on the last two.

With more shares bought on slight dips, your average entry price drops, which means your yield goes up since dividends are calculated on a per-share basis.

Say your goal is $1,000 in monthly dividend income. Using a portfolio of dividend-growth stocks yielding around 4% on average, you’d need roughly $300,000 invested to hit that $1,000/month mark.

By adding $500 bi-weekly, you’re putting in an extra $13,000 a year, not including dividend reinvestments.

With laddered investments, each addition doesn’t rely on market timing; it works with the market’s natural ebbs and flows. If the market dips one week, you pick up more shares.

Over years, this habit, especially in a volatile market, shaves off unnecessary costs and actually increases the total dividends you get from the same invested amount.

Regular, smaller investments keep you from feeling burnt out trying to pick a “perfect entry.” You’re committing to the long-term plan instead of stressing about every market move.

Dividends from new shares you buy immediately get reinvested, compounding your growth. Every new share you accumulate adds a little bit more to your dividend payout, creating a snowball effect.

When unexpected bills pop up, you can adjust without derailing your entire plan. You’re not locking up all your funds at once, so you have a cushion to cover any surprise expenses.

This method works because it’s consistently adding small sums to a growing, income-generating machine. Whether the market is up or down, you’re building your income stream bit by bit.

Over time, even the minor price dips you capture mean more shares at a lower cost, giving you higher yield per dollar invested.

While stocks like Altria Group (MO) (yielding about 8.2%) and Walgreens Boots Alliance (WBA) (yielding 9.6%) might look enticing, they serve as cautionary examples.

These stocks often reach high yields when facing internal or external challenges, such as declining revenues or market share, which can jeopardize long-term dividend reliability.

Walgreens has experienced financial pressures impacting its payout stability, making laddering contributions here riskier if stability is a concern.

The best picks on the S&P 500 for dividend income and reliability include Verizon Communications (VZ), yielding around 6.2%, and Pfizer (PFE), with a yield near 5.7% as of October 2024.

Both of these companies provide consistent dividends and have maintained steady payouts over the years, even in volatile markets.

Laddering your entries into stocks like these allows you to gradually build a solid position without risking too much at any single price point.

This also reduces exposure to sudden downturns.

As a bonus, Verizon has an extensive history of buybacks, which is a good sign because it lowers the share count and, over time, strengthens your dividend per share.

Pfizer, similarly, continues with dividend growth, focusing on long-term payout reliability—a strong quality for anyone relying on dividend income.

Laddering contributions in dividend stocks requires timing that allows for small, consistent investments across market volatility.

For instance, when recent micro-dips (like those seen in volatile trading months in 2024) occur, even weekly dips in stable stocks can lead to lower average entry prices.

Using recent performance data from 2024, S&P 500 stocks averaged a 23.46% YTD return, suggesting that adding regularly would likely have captured at least part of this upswing without excessive risk.

Bi-weekly contributions (or weekly, if you want finer control) add flexibility.

Over several months, this approach helps build a position while weathering minor fluctuations, giving you smoother returns instead of larger single-point entries that are often risky due to volatility in individual company performance.

Beware of “Too Good to Be True” Yields. Stocks that flash high yields can be appealing but often reflect a depressed share price rather than real dividend potential.

High yields can suggest potential trouble in the business or signal a forthcoming dividend cut, as seen with Newell Brands in 2023.

When yields spike above 8%, like with Walgreens and Altria, it’s essential to examine whether the payout is sustainable before committing large funds—even with a laddered approach.

Instead, focus on stocks with strong cash flow and historical resilience.

ALLOCATE FUNDS FROM HIGH-YIELD BONDS DURING MARKET PULLBACKS

Instead of adding cash, consider adding high-yield bonds as a cash proxy. When S&P 500 stocks dip, sell off these bonds and reinvest the capital into dividend stocks.

This approach allows you to fund dips in the market with higher returns than cash and accumulate more shares when they’re undervalued.

When using high-yield bonds as a cash proxy, the goal is to create a pool of capital that grows while waiting for a buying opportunity in S&P 500 stocks.

But even with this approach, it’s crucial to dodge common pitfalls to avoid being blindsided.

First, choose your bonds wisely. High-yield bonds offer better returns than cash but also come with higher risks, especially during economic downturns.

Select bonds with strong credit ratings or consider funds like iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which is highly diversified, reducing risk compared to single bonds.

This way, you’re less exposed to credit events that can heavily impact your cash proxy.

As for which S&P 500 dividend stocks to buy during market dips, look for companies with reliable, attractive yields and a record of strong dividend growth. As of October 2024, some top dividend performers include:

- Euronav NV (EURN) – Offering a yield of nearly 40%, it’s a powerhouse in the energy transport sector. Though volatile, Euronav is strategically positioned, benefiting from strong demand for oil transport and a favorable shipping environment.

- Oxford Lane Capital Corp. (OXLC) – Yielding over 18%, this closed-end fund invests in senior loan funds, which can provide stable cash flows, especially appealing when reinvesting during market declines.

- Ecopetrol S.A. (EC) – A South American oil giant with a dividend yield around 17.5%, Ecopetrol benefits from the global demand for oil and offers steady returns with high dividend coverage, making it resilient to short-term market drops.

When the market dips, resist the urge to sell these high-yield bonds right away.

Wait until the downturn stabilizes—often signaled by lower volatility or positive economic indicators—before selling off the bonds and reinvesting in the undervalued stocks.

This strategy works best when you reinvest in dividend stocks, not only for income but to increase your share count when prices are low, positioning for long-term capital appreciation and enhanced yield on cost.

While high-yield bonds can outperform cash, remember they’re not immune to broader market swings, so diversifying your cash proxy with assets like ultra-short-term bond funds can reduce exposure to bond-specific risk.

And keeping an eye on economic factors, like interest rate changes or corporate bond performance, can help you time your moves in the bond market more precisely.

In essence, combining high-yield bonds with selective S&P 500 dividend stocks can create a self-funding loop for market dips—letting you grow your investments while capitalizing on downturns with fewer blind spots.

USE AN OPTIONS STRATEGY TO GENERATE ADDITIONAL CONTRIBUTIONS

Using cash-secured puts and covered calls on S&P 500 stocks can generate extra income with minimal risk if executed correctly. Selling cash-secured puts at prices you’d be comfortable buying more shares can bring in premium income that you can reinvest. If the price hits, you get additional shares at a lower price, increasing your position.

Let’s say you’ve got $10,000 invested in shares of an S&P 500 stock with a 10% dividend yield, which brings in $1,000 a year in dividends. Now, you add a cash-secured put and a covered call strategy to boost that income.

- Cash-Secured Put: You sell monthly puts on this stock at a strike price around 10% below the current level, earning an average of $30 in premium per month if the stock doesn’t drop to that level.

- Covered Calls: At the same time, you’re selling monthly covered calls at a slightly higher strike, earning another $30 per month if the stock doesn’t rally past the strike.

Together, this adds $60 per month in premium income on top of your dividend. That’s $720 annually from options premiums, bringing your total annual income from the stock to $1,720 ($1,000 dividends + $720 options premiums). With these strategies, your effective yield on the stock rises to about 17.2%, accelerating your journey toward paying off those monthly bills with passive income.

The “Get-Paid-to-Wait” Strategy

With cash-secured puts, you’re effectively “selling insurance” to someone else who wants the option to sell their shares at a certain price. You get a premium payment upfront for agreeing to buy the stock at a predetermined price (the strike price) if it falls to that level.

- How This Works: Let’s say you’ve got your eye on a high-quality S&P 500 stock with a good dividend yield but think it’s a bit pricey right now. You sell a cash-secured put at a lower strike price—the level where you’d be comfortable owning it.

- Benefit: If the stock price doesn’t drop to the strike price, you keep the premium without buying the stock. That’s money straight into your pocket to reinvest in other income-generating assets.

- If the Price Drops: If the stock does fall to the strike price, you’ll end up buying it at that lower price, effectively getting a discount. Now you own more shares at a better price, which boosts your dividend yield on those shares.

Monetizing the Shares You Own

Covered calls are an ideal addition to cash-secured puts because they let you earn extra income from the shares you already own. Here’s how they work:

- How This Works: You sell a call option on a stock you own, giving someone else the right to buy it from you at a set price (the strike price) within a specific period.

- Benefit: You earn a premium upfront, which adds to your dividend income. If the stock doesn’t reach the strike price, you keep the premium and your shares.

- If the Price Rises: If the stock’s price does go above the strike price, you’ll sell your shares at that higher price, capturing a capital gain on top of the premium you collected.

Why Analysts Love This Strategy Right Now

In 2024, many analysts and financial advisors are recommending these options strategies to supplement dividend income. They’re particularly popular because:

- Interest Rates Remain Uncertain: The volatility in interest rates has affected stock prices, making options premiums more attractive. Selling puts or calls in this environment can fetch higher premiums due to the increased uncertainty—meaning more income for you.

- Market Volatility Is Normalizing: With the pandemic market rollercoaster leveling out, analysts see predictable ranges emerging in high-dividend, buyback-rich stocks on the S&P 500. This stability makes it easier to identify comfortable strike prices for puts and calls.

- Income Without Selling: Analysts highlight that this method lets you generate income without liquidating assets, which is key to growing passive income that covers expenses without draining your portfolio.

Don’t get blindsided

Interest Rate and Inflation Impacts: With higher interest rates in 2024, stocks with high debt might see volatility spikes, affecting the feasibility of certain puts and calls. Stocks with manageable debt-to-equity ratios—like Consolidated Edison (ED) or Realty Income Corp. (O)—provide less risk when adding cash-secured puts or covered calls.

Avoiding Excessive Leverage: Many investors get blindsided by using leverage alongside cash-secured puts or covered calls, thinking they can amplify returns. But financial analysts warn that with dividend income as the main goal, adding leverage can destabilize cash flow if markets turn.

Keeping Payout Ratios in Check: When choosing high-yield stocks, be cautious of companies with payout ratios consistently above 80%. For instance, while MPW has a high yield, analysts caution about its sustainability if healthcare sector headwinds continue. Finding stocks with lower payout ratios (under 70%) but consistent dividends increases the likelihood of steady passive income without sudden cuts, a risk many overlook in high-yield plays.

Market Timing Temptations: Trying to time options too closely with market news can be risky. Stick to the fundamentals—focus on stocks you’re comfortable owning and avoid chasing the highest premiums.

Premium Greed: Some stocks offer juicy premiums, but that can signal higher risk. Prioritize S&P 500 stocks with stable cash flows and strong financials, even if the premiums are more moderate.

Misusing Cash-Secured Puts: Don’t sell puts on stocks you wouldn’t want long-term. If you’re assigned (meaning the price drops and you’re required to buy), make sure you’re happy holding that stock.

With the right stocks, you’ll be building passive income faster than with dividends alone, and you can still rely on those dividends as your base income. Options premiums essentially act like “extra dividends” that you’re getting on a monthly basis, helping you reach your income goal sooner.

With time and patience, these layered income streams can help cover all your major expenses while letting you hold on to your shares and continue building wealth.

What are Cash-Secured Puts?

Cash-secured puts allow you to collect premium income by selling options at a “strike price” you’d be comfortable paying if the stock were to dip.

This strategy allows you to take on a stock position at a discount if the price drops, while still earning premium income if it doesn’t.

It’s a powerful tool for creating extra income without excessive risk.

1. Selecting High-Yield S&P 500 Stocks

Financial analysts in 2024 are highlighting the profitability of stocks with both dividend growth and volatility within safe margins. Examples include:

- Lumen Technologies Inc. (LUMN): Known for its volatility, it offers a high yield and is relatively inexpensive. Analysts point out that its fluctuations make it ideal for put options if you want steady premium income and are comfortable owning it at lower levels.

- Medical Properties Trust, Inc. (MPW): Yielding close to 14%, MPW is often overlooked due to healthcare sector skepticism, but its high dividends, paired with recent volatility, make it an attractive target for cash-secured puts if you’re open to healthcare REITs.

2. Timing and Strike Price Strategy

Analysts suggest placing cash-secured puts with strike prices slightly below the current stock price to give yourself a comfortable entry point if the stock dips.

In 2024, market conditions are experiencing sector rotations, so timing these puts when sectors face temporary pullbacks—such as in healthcare or utilities—can help you get premium income while potentially adding discounted high-yield stocks to your portfolio.

3. Benefits of Premium Income

By consistently reinvesting premium income from cash-secured puts into other dividend-paying stocks or reinvesting it back into the S&P 500, you’re compounding your wealth at a faster rate.

Financial experts call this a “self-funded growth strategy” where you’re not relying on stock performance alone but also on options premiums to increase your passive income potential.

Covered Calls on Existing Holdings

Covered calls let you earn extra income on stocks you already own by selling the option for others to buy them at a higher price.

This creates consistent cash flow while you still collect dividends, but it requires choosing stocks less likely to experience unpredictable upward swings.

1. Choosing Covered Call Stocks in the S&P 500

Look for stocks with stable to moderate growth projections, especially in the energy, financial, and telecommunications sectors. For example:

- Oneok Inc. (OKE): This energy company offers a high yield and is not prone to extreme volatility, making it a candidate for covered calls. With OKE, you’re earning solid dividends and can generate additional income on any shares you already own by setting covered calls at slightly above-market prices.

- Verizon Communications Inc. (VZ): Known for stability and consistent dividend payouts, Verizon’s predictable movements are ideal for covered calls, as you’re less likely to lose shares to a surprise rally, ensuring both premium income and steady dividend income.

2. Strike Price Strategy for Covered Calls

Financial analysts recommend setting covered call strike prices slightly above your target exit point. This allows you to collect premium income while protecting your upside if the stock rallies.

If Verizon is trading at $33, you might sell a covered call at $35, generating premium income without immediate risk of losing shares.

3. Income Potential from Covered Calls

The premium from covered calls compounds with your dividends, which is crucial for covering all expenses with dividend income.

Analysts highlight the importance of reinvesting this premium income into further dividend stock purchases or simply accumulating it to increase your base capital, thus maximizing the dividends over time.

Step 3: Reinvest All Dividends

REINVEST DIVIDENDS IN SMALLER, HIGH-GROWTH STOCKS

Use dividends from S&P 500 investments to selectively invest in smaller-cap stocks with high dividend growth potential. By reinvesting in companies with faster-growing dividends, you amplify compounding, even if they don’t yet make up the bulk of your portfolio.

USE DIVIDEND CAPTURE STRATEGIES DURING EX-DIVIDEND CYCLES

This strategy involves buying S&P 500 stocks right before the ex-dividend date and selling right after dividends are paid. This can be risky but, if carefully managed, can allow you to collect dividends without holding long-term positions. Profits are then redirected into your core holdings.

THINK ABOUT USING A SYNTHETIC DIVIDEND REINVESTMENT PLAN (DRIP)

Instead of traditional DRIPs, where dividends are reinvested into the same stock, employ a synthetic DRIP by channeling dividends into a separate, high-yield dividend stock that aligns with your goals. By diversifying reinvestments strategically, you increase the overall dividend yield and can target stocks with faster growth to amplify compounding.

Step 4: Be Patient and Give the Strategy Time to Work

FOLLOW A DIVIDEND STACKING MODEL

Create a structure where each dividend stream is earmarked for specific expenses. By allocating individual dividends to cover particular recurring costs (e.g., rent, utilities, etc.), you create psychological milestones that encourage patience. This allows you to track the crossover from dependency on earned income to dividend income for each of your needs.

LEVERAGE RECESSION OPPORTUNITIES AGGRESSIVELY

During recessions, the S&P 500 often declines, creating a prime buying period for dividend stocks. By maintaining a “recession fund” that you deploy exclusively in downturns, you buy high-quality S&P 500 dividend stocks at a steep discount, enhancing your dividend yields and future payouts. Few investors have the discipline to save capital exclusively for downturns, but it provides exponential returns.

UTILIZE A TARGETED DIVIDEND GROWTH LADDER

Structure your portfolio to hold a mix of stocks with varying dividend growth rates and yields, creating a ladder of increasing payouts over time. Start with lower-yield, higher-growth stocks and gradually add higher-yield, lower-growth stocks. This approach creates a self-sustaining growth cycle that maximizes dividend increases over different time frames.

Step 5: Continue Until You Reach Your Dividend Crossover Point

REVIEW AND AGGRESSIVELY REINVEST EXCESS DIVIDENDS

Once dividends cover your bills, don’t stop reinvesting the surplus—instead, ramp up reinvestments into sectors or companies with temporarily undervalued dividends. This strategy boosts your dividend income exponentially and offers a buffer against inflation or unforeseen expenses.

SET UP A DEDICATED DIVIDEND FUND

Build a reserve fund that holds excess dividend income. This allows you to set aside dividends during bullish markets to cover expenses in any years where dividends might be temporarily cut or reduced. A dividend reserve fund can safeguard your crossover point in volatile markets, adding an extra layer of stability that others overlook.

SWITCH TO TAX-SMART HIGH-YIELD INVESTMENTS

As you approach full dividend coverage of your bills, gradually shift a portion of your S&P 500 holdings to high-yield, tax-efficient investments. These might include dividend-oriented REITs, utilities, or MLPs with tax advantages that ensure your net income remains high, even after taxes.